Retirement Paycheck Sources

As a state of Missouri employee, your income in retirement will come from three primary sources: your defined benefit pension from either MOSERS or MPERS, social security, and your personal savings.

1. Defined Benefit Pension Plan

Eligible state of Missouri employees will receive guaranteed monthly income from their defined benefit pension throughout their retirement years. Your defined benefit pension from the State of Missouri will come from either MOSERS or MPERS.

Missouri State Employees' Retirement System (MOSERS)

MOSERS administers retirement, life insurance, and long-term disability benefits to most state employees.

MoDOT & Patrol Employees' Retirement System (MPERS)

MPERS provides retirement, disability and death benefits to employees from the Missouri Department of Transportation (MoDOT), Missouri State Highway Patrol (MSHP) and MPERS staff.

2. Social Security

Social Security is the foundation of economic security for millions of Americans—retirees, disabled persons, and families of retired, disabled or deceased workers.

Just like the defined benefit pension plan, these are guaranteed payments made to retirees throughout their retirement years.

For a better idea of the amount you can expect to receive from social security, visit their Retirement Estimator tool at www.socialsecurity.gov/estimator. You can also view your official social security statement online by creating an account at www.socialsecurity.gov/myaccount.

Deciding how and when you receive Social Security retirement benefits can significantly impact your retirement security. Use the Social Security Checklist to help identify what you need to know.

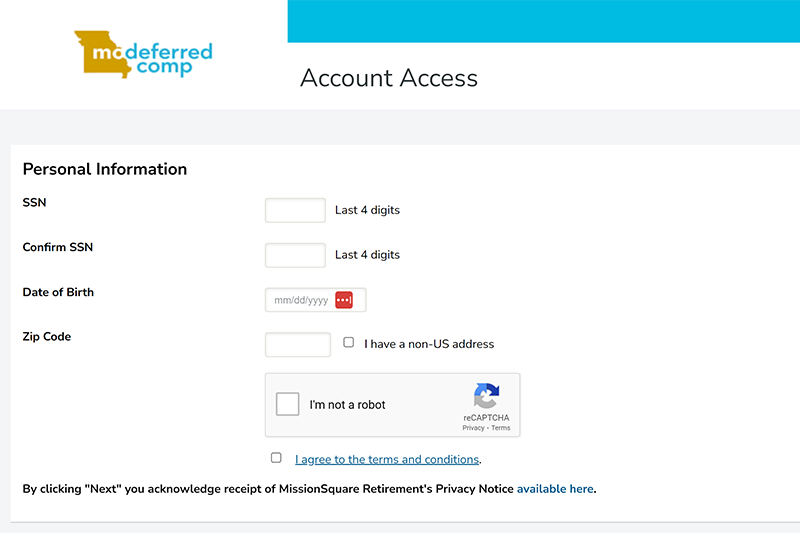

3. Personal Savings

Generally, the income you receive from your defined benefit pension and social security may not be enough to meet all your financial needs in retirement. Saving and investing additional money throughout your working career can help fill any income gap you may have. This is where the MO Deferred Comp Plan comes in. Deferred comp is a personal retirement savings account — designed for state employees — that will provide a necessary form of pay when you quit working. Employees contribute to this account throughout their career, direct their own investments, and manage their own balance in retirement.